11:10 AM 2016/2017 Budget – Part 1 - Getting Around State Government Election Promises. | |

As you may be aware, the Victoria state government introduced the 'Fair Go Rates System' to start in 2016/2017. The purpose of this legislation is to keep our council rate increases at the same level as CPI, that is our rates are meant to increase at around 2.5% per year. In the past, our council rates have increased at around 4% to 8% per year which was well above increases in Average Weekly Earnings and above just about every other income and cost increase index produced by the Australian Bureau of Statistics. (I examine the ABS statistics and the statistics Manningham council use to justify their massive rate increases in other articles on this website). I think we were expecting our rates for the coming year to increase by 2.5%. After all, that is what we were led to believe by the state government's election promise. But that is probably not going to happen.

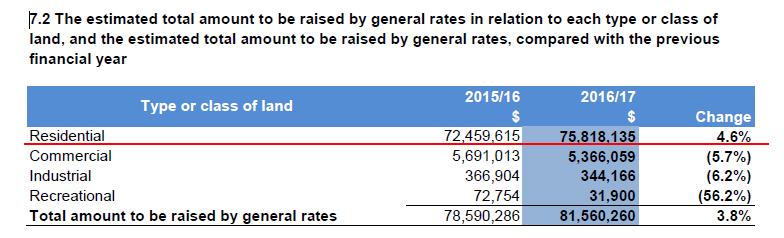

What is in Manningham Council's 2016/17 Budget? Let me show you this table from the Manningham 2016/17 Budget, page 39.

As you can see above, total council rates to be collected from residential properties are set to increase by 4.6% in dollar terms for the coming year. But note that this is the total rates to be collected. Because the number of residential properties has increased slightly, this cost will be spread over more homes. As a result the average (and I emphasize the word 'average') general rate increase for residential properties will be somewhere near 3.27%.

From the Council's budget documents it appears that residential rates for 2016/17 will increase, on average for residential properties, by 3.27%. The point is that this is not the 2.5% increase in general rates we were led to believe would happen. Please see the state government press release here.

How did Manningham spike our residential rates? How did Manningham council increase our rates at more than 2.5% but still remain within the law? Please allow me explain.

It came about for two reasons. 1) The Victorian State Government. A mistake that Labor governments tend to keep repeating is that they do not put enough thought into the wording of their legislation. They usually have good intentions but do not implement their plans well. This can be said of their initial legislation to increase the population of Melbourne without contributing to urban spread. It is now acknowledged that their legislation lead to many inappropriate developments around Melbourne. It was subsequent governments and local councils that refined this plan into something that was more workable, practical and that people could live with. This has also happened with the Fair Go Rates System. The state government specified that TOTAL council rates must not go up by more than 2.5%. Note the word 'TOTAL'. This left to door open to all sorts of shenanigans to go on within local councils. 2) Manningham Council shenanigans. Please examine the table above. Note that there are sizable reductions in the amount of rates that commercial, industrial and recreational land owners pay. By granting rate reductions to commercial, industrial and recreational properties, Manningham council is able to increase rates for residential properties well above 2.5% but still keep the total rate increase to 2.5%.

Are rate reductions for Recreational Land justified? The large reduction in recreational land rates is probably due, in part, to the sale of the Eastern Links Golf course. A large and valuable area of recreational land has changed to become residential land. A reduction in the amount of recreational land would bring about a reduction in the rates received from those lands. HOWEVER, the problem I have with the reduction for recreational land is that the Eastern Golf Course DOES NOT represent 56.2% of the recreational land in Manningham. So it would seem safe to say that hidden in this 56.2% decrease in rates from recreational lands is also a decrease in the valuation of recreational land when compared to residential land.

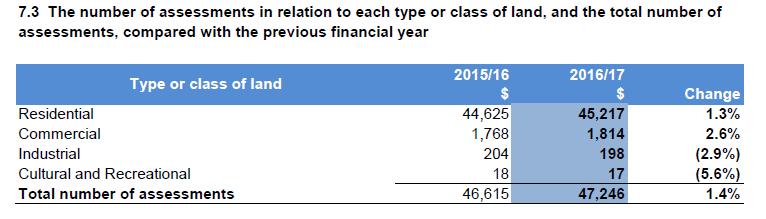

Are rate reductions for Commercial and Industrial Land justified? It is not as though the number of these properties has changed to the same degree as the rates they pay. Please see the table below also taken from page 39 of the 2016/17 budget.

(Please note this table shows the number of rateable properties, not dollars. The $ in the table above is an error.) Note how the number of commercial properties has increased from 1768 to 1814 (2.6%) but the total rates Manningham received from these properties has DECREASED by 5.7%. The same for Industrial. The number of industrial properties has decreased by 6 (2.9%) but the rates the council receives from these properties has DECREASED by 6.2%. Manningham council may say that residential properties have increased dramatically in value while commercial, industrial and recreational land values have not. But that would not be entirely accurate. It is certainly not true for commercial properties. Those of you running your own self managed super funds and investing in commercial properties will know that commercial property prices in Manningham have been increasing in price and in some locations are almost experiencing a boom in prices. For example at Greythorn village, one shop sold in December 2015 for around $900,000. Just four months later, in April 2016, a shop two doors down, the same size but in poorer condition sold for $1,350,000. This was an increase of around 50% in just four months. In Tunstall Square the liquor shop was sold recently. The agents were expecting to get around $2.2 million. Instead it went for around $2.8 million. This steady increase and localized boom in commercial property prices has been going on for quite a while. So it is not entirely accurate to say that only residential properties have increased significantly in price. Certainly commercial properties have experienced a comparable increase in price.

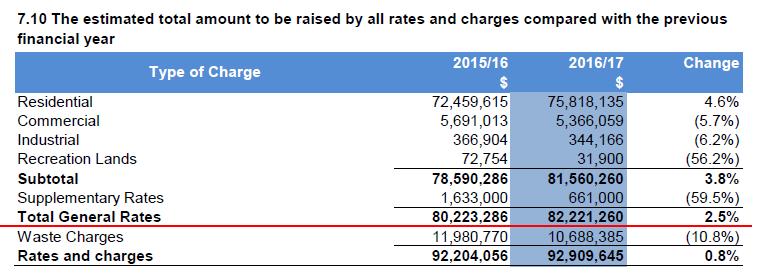

How did Manningham Council keep to the letter of the law? How did Manningham council increase residential rates by 3.27% while the state government led us to believe they would only go up by CPI, that is around 2.5%. Let me show you one more table from the budget which shows how Manningham has fulfilled the letter of the law, but maneuvered their way around so they could do what they always do – increases our rates by as much as they can.

Note how the TOTAL rates in dollar terms (excluding waste charges) has increased by 2.5% as per the legislation. But what Manningham council did was move the rate burden around. All properties except residential properties have experienced a significant decrease in council rates. Even "supplementary rates" has decreased significantly. All, that is, except residential rates. By reducing the valuations of Commercial, Industrial and Recreational properties in comparison to residential properties, they have shifted the rate burden away from these properties and onto residential properties. Manningham Council has effectively undermined the promise of the Victorian State government made to limit OUR rate increases to CPI. Residential property rates have increased by more than the 2.5% because of poor wording in the legislation and by the scheming of Manningham Council. I think that what the state government should have done is specify that residential property rates must increase by no more than 2.5%. Or better still, say that rates in all categories can increase by no more than 2.5%. This would have been reasonable since all ratepayers had been led to believe that their rates would go up by CPI and no more. Please see the state government's press release in the link above. What we have is very uneven rate increases that suites Manningham Council's agenda.

How did Manningham Council shift the rate burden? Manningham Council has had quite a while to prepare for the Fair Go Rate System. To be able to move the rate burden from one group of properties to another (commercial, industrial and recreational to residential) you need to change the valuation of a large number of properties to different degrees. The way the rates calculation works is a bit tricky. Basically council values all properties in Manningham and comes up with a total value for all properties. Your property is given a particular value. And your property represents a certain very small fraction of the total value of all properties in Manningham. Then Manningham calculates the total amount of rates they want to collect. Then they divide up that total rate amount. The fraction you pay of the total rates is the same fraction that your property is to the total value of all properties. So if your property value increases, the fraction of the total council rates you pay may or may not change depending on how the value of the other rateable properties has changed as well. From this you can see that if you want to move the rate burden from one group to another, the valuation of properties in a group must change. The values of properties in one group must go up and the values of properties in the other group must go up to a much lesser extent. The rate burden will move to the group whose property values have increased the most. What our council is saying in their budget document is that the value of commercial, industrial and recreational land has not increased anywhere near the degree that residential property has. And I would say that is not entirely true, at least not for commercial properties in Manningham.

Property Revaluation - Separate but not really Separate. Manningham council has been telling us for a while that this round of property revaluations was completely independent of the Fair Go Rate System and was planned to happen anyway and has no bearing on the implementation of the Fair Go Rating system. The mayor told us this some months ago and this is repeated in the 2016/17 budget and other documents. And this is true -- as far as it goes. It is true that the property revaluations are a regular process and take place independent of the introduction of the Fair Go Rating System. But Manningham has been emphasizing this independence so much in recent months that they started to make me wonder. For example: (Page 1 of the budget.)

And this is not the only time Manningham Council has taken the opportunity to emphasise that the revaluations are independent to the Fair Go Rate System. Manningham Council knew that the property revaluations just completed would lead to changes in the amount of rates each property pays. Please see the following statement from page 38 of the budget . Please see point b).

Manningham council openly says that it was the property revaluation that moved a greater burden of the rates onto residential properties and away from commercial, industrial and recreational properties. Manningham council wants us to think that this was just something that happened and was entirely natural. That is, residential property prices have increased while commercial, industrial and recreational land prices have increased to a much lesser extent. But Manningham council knew how the property revaluation works. And they have taken every opportunity they can to emphasize that the revaluation is independent of the Fair Go Rate System. I find that rather suspicious. What I suspect happened is this: Manningham had time to prepare for the Fair Go Rate System and knew the property revaluation would effect how much of the total rate burden each section of the community pays. From what the council has said and from what they have repeatedly denied, I think they used the property revaluation to achieve their objective to move the rate burden from commercial, industrial and recreational properties to residential properties. I am suspicious that during that revaluation they slanted the numbers to get what they wanted.

But why move the rate burden to Residential Properties? Everyone knows that the ordinary worker earns money but then does very little constructive with it. They spend it on entertainment, home improvements, holidays, food and so on. They don't employ anyone, they don't manufacture anything. And so, over the years, the employed worker has been treated as a cash cow by one government after another. Even now (May 2016), the Federal government is trying to raid the pension accounts and at the same time reduce the tax burden on small businesses. Why? Well, small businesses employ people, they make things, they add to GDP, etc. They need to be encouraged and promoted. Sometimes they are described as the powerhouse of the economy. Manningham Council is also required to promote small business within Manningham. The state government measures the performance of Manningham Council in this very area. What Manningham Council does is count the number of ABNs registered in Manningham and uses that as a measure of how well they promote small business. But that is complete rubbish and I think many realise it. I have a ABN registered but none of my business activities take place in Manningham. All my clients are on the other side of the city. Also my son has just registered an ABN. The company he works for and all their clients are also on the other side of the city. We just happen to live in Manningham. Manningham Council wants to lay claim to our business activity as something that THEY promoted. It is complete nonsense. And the state government might be pressuring Manningham Council to better measure their success in this area. A better way of promoting small business in Manningham would be to reduce the council rates for commercial and industrial properties. And that is probably what is going on.

| |

| Views: 886 | Added by: Blogger | |