10:07 AM A Grumbling Council | |

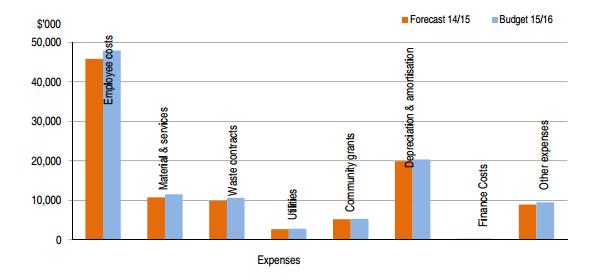

The state government proposes to cap rate increases for local councils. Local councils will only be able to increase rates at around the CPI each year. The CPI is currently somewhere around 2.4%. Currently Manningham council increases our rate bills each year by outrageous amounts of 5% and higher. And they have been doing this for many decades. So what does Manningham council have to say about this state government proposal? "The State Government has announced it's intention to cap rates in local government commencing in the 2016/2017 financial year. Full details of this policy were not available at the time of preparation of this document, but early indications are that rates will be capped at something approximating CPI. This will significantly reduce council's ability to generate revenue, and therefore provide funding to maintain current services and service levels, and also will reduce funding available for the capital works program" - Page 64, Annual Budget 2015/2016. Reading this, you would think our roads are going to deteriorate, our parks and gardens will be overgrown and we should all be very worried about what the State Government is going to do. But just a minute. A 2.4% increase will easily cover the increase in costs for the council. It would cover the increase in costs for roads and buildings. So the council could easily maintain current services at existing levels. (There are several other articles on this site that go into detail regarding cost increases for roads, buildings and so on for councils using ABS statistics.) The real question is what will 2.4% NOT cover. Do you know that council staff currently receive annual pay increases of between 3.2% and 3.4% (depending on which council document you read). An annual increase of 2.4% will not allow for their outrageous pay increases each year. AND THAT is most likely what the council is complaining about. Also, more importantly, it will effect their superannuation payouts. Superannuation payouts for council staff are a multiple of their average salary for the last two years of work, just prior to retirement. That is, calculate their average salary for their last two years of work. Then multiply this average salary by some number to obtain their superannuation payout. However they will not tell us what this number is. When the defined benefits scheme was abandoned in private industry back around the 1980's, this number for retiring private industry workers where I worked was 6.25. So back then retirees received 6.25 times their average salary over the last two years as their super payout. You can safely assume that this multiplying number for government workers will be 6.25 or more, probably much more. So multiply the average salary of council staff by, say 7, and that is the superannuation payout. Some senior employees at Manningham Council are on more than $300,000 per year. So their superannuation payout will be well over $2 million. And that $2 million is guaranteed. It does not depend on the performance of investments like your or my superannuation does. If the investments do not perform as expected, the council has to find the money to cover the shortfall. If you think about the above calculations, it will soon be clear that it is in the council workers best interest to increase their salaries as much as possible just prior to retirement. Reducing rate increases to 2.4% means they have to live with salary increases of around 2.0% like the rest of us in private enterprise and not the 3.4% increases they are used to. (If you look at ABS statistics, salaries increase annually on average around 2.0% for private sector workers and 3.0% for public sector workers, depending on which year you look at.) This is what Manningham council is probably really grumbling about. Increasing rates at CPI should not effect council services at all. But it will effect their pay increases and also their superannuation payouts, and that is probably the real problem. Will capping the rate increase to CPI effect our roads, gardens and other public facilities? Yes, possibly. What our council will most likely do is reduce expenses in other areas so they can retain their 3.2% annual pay increases. This is the way our council works. They always come first. Their pay, their superannuation, their often concocted jobs must be protected first and foremost. They would never think of reducing their pay rates to 2.1% or eliminating pointless, ineffective or concocted jobs like we often need to in private enterprise. A good indication that Manningham council put themselves first and that the majority of our rate increases go to lining their own pockets can be found in their own documents. This graph is taken from page 38 of the 2015/2016 budget. Take a look and see if you can find where the majority of the increases in spending go.

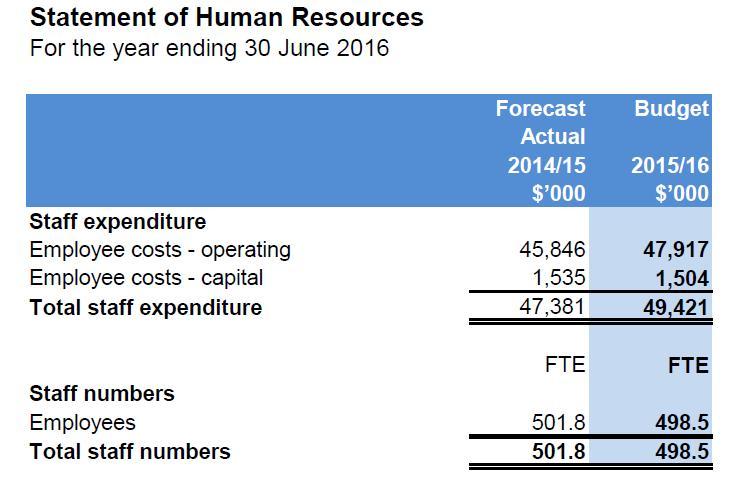

Now some might say that the increase in employee costs is because the council is taking on new staff. But please look at this graph below from page 73 of the same 2015/2016 Annual Budget. We see the staff numbers are actually decreasing next year by 3.3 FTE. (FTE is 'Full Time Equivalent' staff. That is, all the part time, casual staff hours are added to arrive at the equivalent full time staff.) So actually it is more money going to fewer staff. I think this is why our rate bills increase so much each year and why Manningham Council cannot reduce the growth in rates to only 2.4%.

| |

| Views: 1007 | Added by: Blogger | |